Analysis of Q1 2025 Earnings: American Tower, SBA Communications and Crown Castle (+ Vertical Bridge & more)

Application activity has been strong in 2025, with all four major U.S. tower companies—American Tower, SBA, Crown Castle, and Vertical Bridge—reporting increased demand. Despite this momentum, they remain cautious on large-scale acquisitions, citing high valuations and a limited pool of viable assets. Ground lease buyouts remain steady, with American Tower spending $44.9M, SBA $9.2M, and Crown Castle $18M.

At JW Tower & Telecom Consulting, we partner directly with landlords to help them make informed, strategic decisions regarding:

📝 New Lease Negotiations – We ensure landlords don’t leave money on the table when carriers approach with new tower or rooftop agreements.

🔄 Lease Amendments & Extensions – Whether it’s equipment upgrades, lease renewals, or rent escalations, we review and negotiate terms to protect long-term value.

💰 Lease Buyouts – We help landlords evaluate buyout offers, negotiate better terms, and understand the impact of selling their lease rights.

📞 Reach out today: jw@jwttc.com | (720) 295-5333

American Tower

Q1/2025 Applications are up 60% from 2024

Re: Larger scale acquisitions:

“we'll continue to be opportunistic where you find the right portfolio at the right price. We don't see any large scale opportunities that are taking us off of our path. And so we've been pretty clear about that for the past few quarters. That hasn't changed. We're still not seeing any huge opportunities out there that we think are compelling enough.” -Steve Vondran, President and CEO, American Tower

There remains a major carrier that doesn’t have a holistic / comprehensive agreement with American Tower":

“For us, it's really about whatever drives the best long term value. And if you look at our leading growth that we had today, it's a function of what we signed in our Ts and Cs twenty years ago. And we'll continue to be disciplined about that. We'll continue to do what is the best thing for our customers and our shareholders in terms of negotiating those agreements over time.” Steve Vondran, President and CEO, American Tower

Capital spend for ground lease purchases (Lease buyouts / easements) totaled $44.9M

SBA Communications

Added 344 sites for $58M (mostly related to Millicom in Nicaragua)

Re: Larger Scale Acquisitions:

“If you’re talking about the U.S., because there is a limited supply of potential assets, and there are a lot of people very interested in acquiring U.S. towers. When those opportunities come about, the private valuations are much, much higher than the public valuations, and that makes it a challenge for us.” Brendan Cavanagh, President and CEO, SBA Communications

SBA has an MLA with AT&T, open to discussions with others:

“We’ve always had master lease agreements in place with our customers, but they’ve usually been equipment-specific in terms of how they paid us for the use of our sites. The exception to that was the deal we did with AT&T a couple of years ago, which was more of a holistic approach. We’re open to a holistic approach with our customers, but it really is just dependent on the specific give-and-take within the negotiations around those agreements. So, yes, we’ll just have to see how it goes. But at this point, the only true holistic agreement we have in the U.S. is the one that we signed with AT&T a couple of years ago.” Brendan Cavanagh, President and CEO, SBA Communications

Re: DISH Network / Boost potentially leasing their spectrum:

“Yes. There’s — at this stage, they have — there hasn’t really been any specific conversations in terms of the leasing. If they do lease their spectrum, their contract doesn’t allow for that to change it’s in somebody else’s hands. So there would have to be a conversation, and we’ve not had that conversation as of yet. In terms of just their broader commentary and feedback with us, we work pretty closely with them. They on the operation side are very clear about their desire to continue to pursue their standalone greenfield network. At this stage, obviously, things are much slower in terms of leasing activity with them. So we’re hopeful that changes. But at this stage, it’s really just meeting some very basic needs,” Brendan Cavanagh, President and CEO, SBA Communications

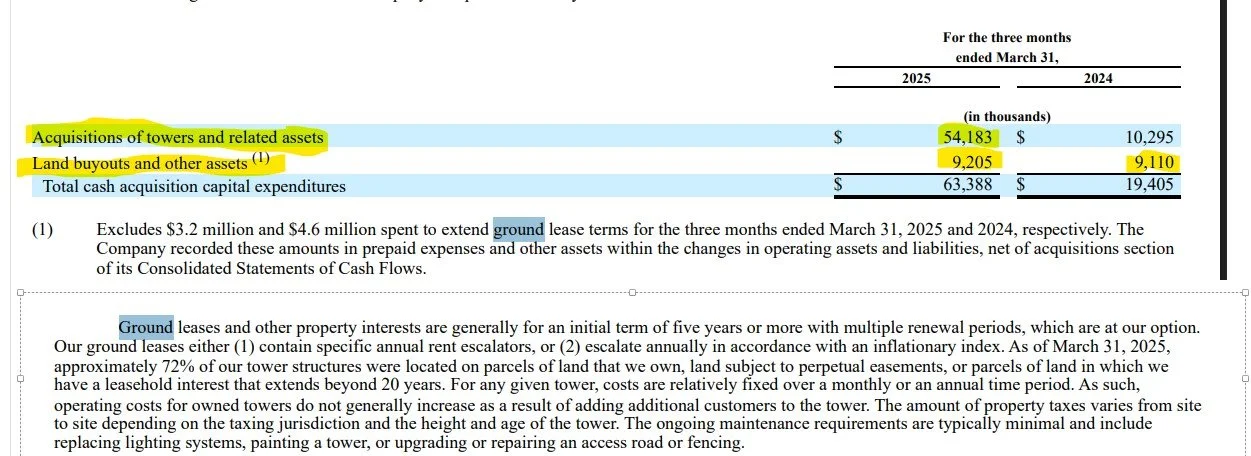

Capital spend ground lease purchases (Lease buyouts / easements) totalled $9.2M (up from $9.1M in Q1/2024)

Crown Castle

Re: Larger Scale Acquisitions:

“..given where we are with major sales transactions going on (small cells / fiber business), M&A for us in the short term is unlikely.” Dan Schalanger, Interim President and CEO, Crown Castle

Capital spend ground lease purchases (Lease buyouts / easements) totalled $18M (up from $13M in Q1/2024)

“I think we’re really well positioned going forward and excited that we have a story that is focused on The US tower market only because I think it’s a great market and it simplifies our story and allows us to focus on the things that are most important to us, which are creating more value through growing our revenues and reducing our costs, which is what we’re focused on.” Dan Schalanger, Interim President and CEO, Crown Castle

This strategy was reiterated at the Connect(X) WIA Conference in Chicago by Crown Castle’s Executive Vice President and Chief Operating Officer Cathy Piche

Vertical Bridge:

Vertical Bridge, the largest privately held communications tower company in the U.S., played a visible role at the recent Connect (X) WIA Conference in Chicago, contributing meaningfully to several panel discussions.

In Q1 2025, application activity at Vertical Bridge surged—up more than 50% compared to Q1 2024

M&A remains active across the industry, deals are happening at a smaller scale, with high multiples for quality assets due to intense competition

Vertical Bridge continues to actively pursue acquisitions and build-to-suit (BTS) programs in partnership with carriers

As a private company, their capital spend on ground lease purchases isn’t publicly disclosed, but based on observed activity, they appear to be strategic—if somewhat selective—in their approach

Their recent $3.3 billion transaction with Verizon may signal a focus on securing long-term control of key assets within their portfolio

#Celltower #celltowerlease #verticalbridge #americantower #crowncastle #sbacommunications #leasebuyout #sitedevelopment #newtowerbuild #telecommunications